არაფერს

მე ვერ გამოვიყენე ინდიკატორები ეს იმას არ ნიშნავს რომ სხვა ვერ იყენებს მათ წარმატებით ან რომ არ უნდა შეისწავლო ისინი.

1) This is the beginner trader cycle that most traders start out with when they first enter the forex market, or begin trading any financial market.

The Beginner trader enters the world of tech indicators and chart patterns.

Stage 1: Technical Indicators, Stochastics, MACD, Moving Averages, RSI, etc

Stage 2: Try finding divergence with the technical indicators. Try using multiple technical indicators together. Clutter their charts. When that fails they go to stage 3.

Stage 3: Find the next great technical indicator – aka the search for the holy grail

Stage 4: When the next great technical indicator fails they go to find new expert advisors aka forex robots

Stage 5: Pile on even more clutter on their charts. Try even more technical indicators that they never used before. Anything they can find like Bollinger Bands, Keltner Channels, Fibs, Pivot Levels, momentum, etc.

Stage 6: Try even more technical indicators. Use Elliot Waves, ADX, Linear Regressions, Parabolic SAR, etc

Stage 7: They try to tweak the settings on their technical indicators to see if that works. They can also try using the technical indicators on multiple time frames to see if that increases the probabilities of the trade.

At this point the trader starts the viscious cycle over again and keeps on trying to find success using technical indicators. The beginner trader jumps around from system to system on various trading forums, never building any solid foundation for trading success.

This whole process can be very frustrating as the beginner trader cannot find consistency and it becomes very difficult to break out of the cycle. Many traders quit at some point in this cycle. I went through this cycle for over one year.

Of the ones that do survive, many of them enter the price action trading cycle.

2) Price Action Trader Cycle

This is the price action trader cycle that many traders progress into after the technical indicator rat race.

You discover that Price Action Trading is better than technical indicator trading.

You start learning about Price Action Trading.

You start to learn about all the Price Patterns and Chart Patterns. You start “Trading Naked.”

You start to add just a few tools to help you such as one or two key moving averages. You begin to use some fibs, support and resistance, and price pivots.

Perhaps you start to add a few trendlines. You start using the techniques with multiple time frame analysis.

You try to add some filters and additional confirmation such as only trading with the trend, or psychological and round numbers.

Eventually you want some more confirmation, some more filters, and you eventually add some tech indicators.

You may also start looking for MACD divergence with price action setups.

After you have gone through the price action trader cycle this eventually leads you back into the technical indicator rate race for many people.

You start going back and forth between the technical indicator cycle and price action trader cycle. You get confused about where the next level is. Well order flow trading is the next step up.

3) The Order Flow Trader Cycle that you progress through and eventually get to massive profit.

You start learning about Order Flow Trading.

You start learning about Stop Hunting.

You try to trade using knowledge of stop loss hunting.

You start to learn about News Trading.

You incorporate News Trading with Stop Hunting.

You start to learn about market sentiment and market sensitivity.

You eventually learn to place swing trades.

You eventually learn about Global Macro Trading.

You Combine Stop Hunting, News Trading, Market Sentiment, Market Sensitivity, And Global Macro Trading Into The Super Order Flow System.

This post has been edited by samyarozrunavs on 2 Jan 2014, 16:41

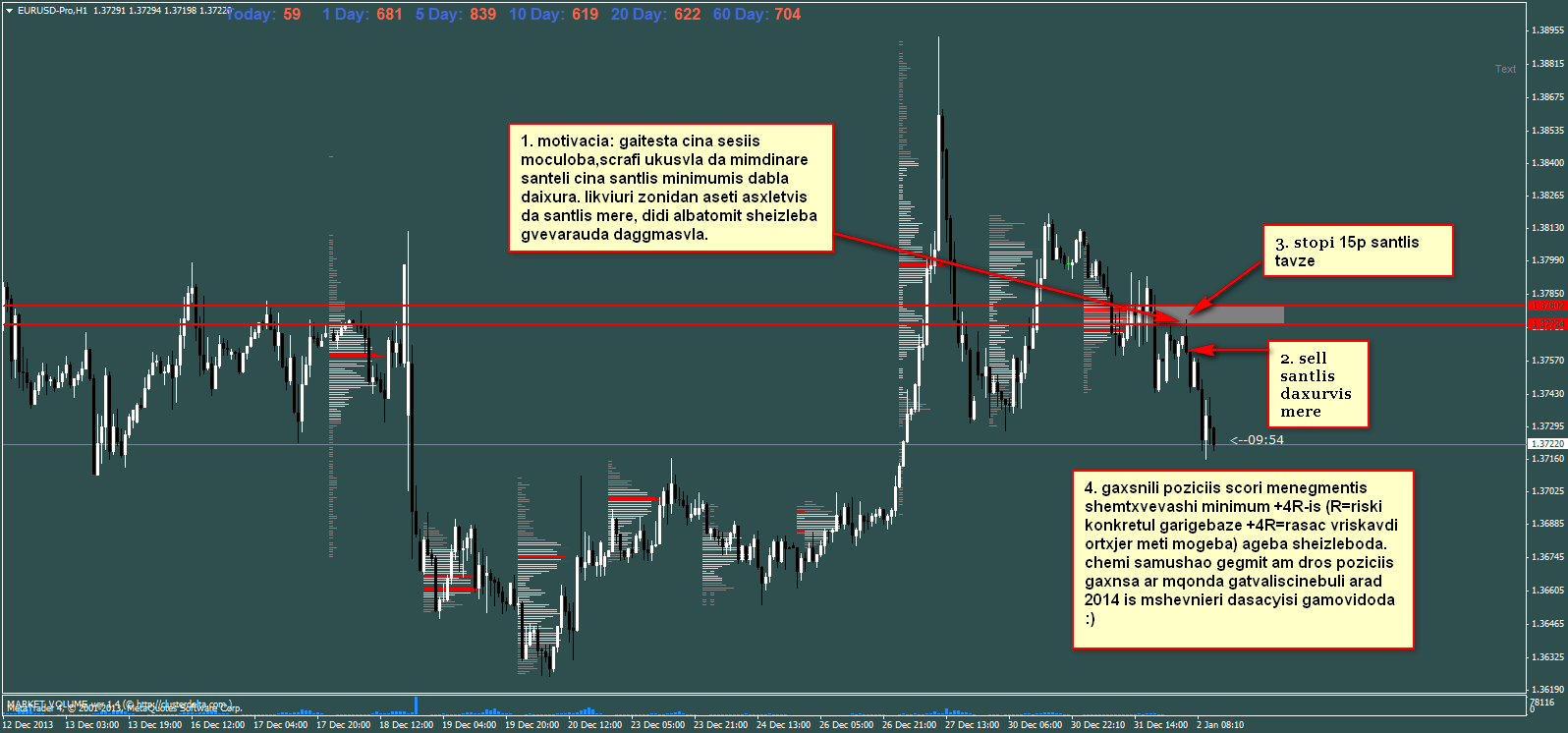

მიმაგრებული სურათი (გადიდებისთვის დაუწკაპუნეთ სურათზე)